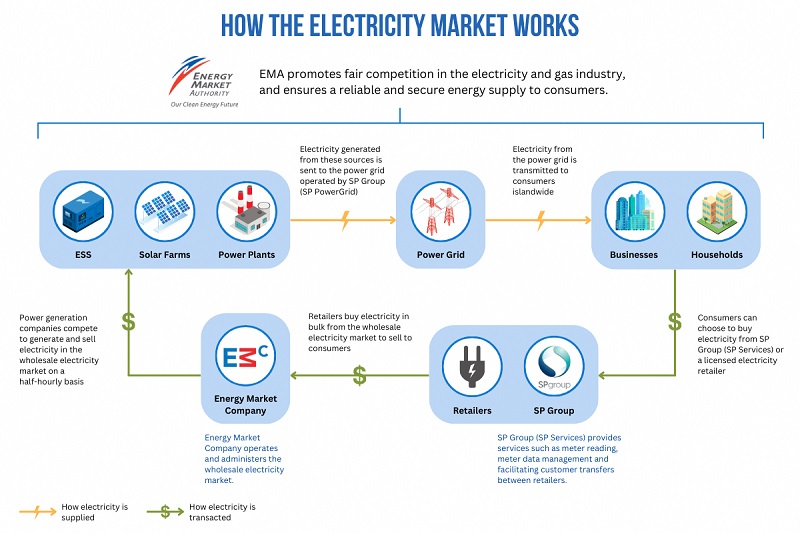

Power generation companies have to bid to sell electricity in the wholesale electricity market every half-hour. Depending on electricity demand and supply, the price of electricity in the wholesale electricity market changes every half-hour.

Meanwhile, electricity retailers buy electricity in bulk from the wholesale electricity market and compete to sell electricity to consumers.

To further strengthen the Singapore Wholesale Electricity Market (SWEM), EMA introduced a Temporary Price Cap (TPC) mechanism that acts like a 'circuit breaker' during sustained periods of extreme price volatility in the SWEM.

Please refer to this page for the bi-weekly TPC parameters, and the Energy Market Company website for the real-time and historical half-hourly trading data.